Referendum 2024

In 2016, voters residing within the Brown County Schools district approved an eight-year operating levy of $0.08 per $100 of assessed property value. Thanks to our community’s support of the operating referendum, BCS was able to continue funding the Brown County Schools Career Resource Center, and provide support for our teachers, staff, and innovative educational programs for our 1,450 students.

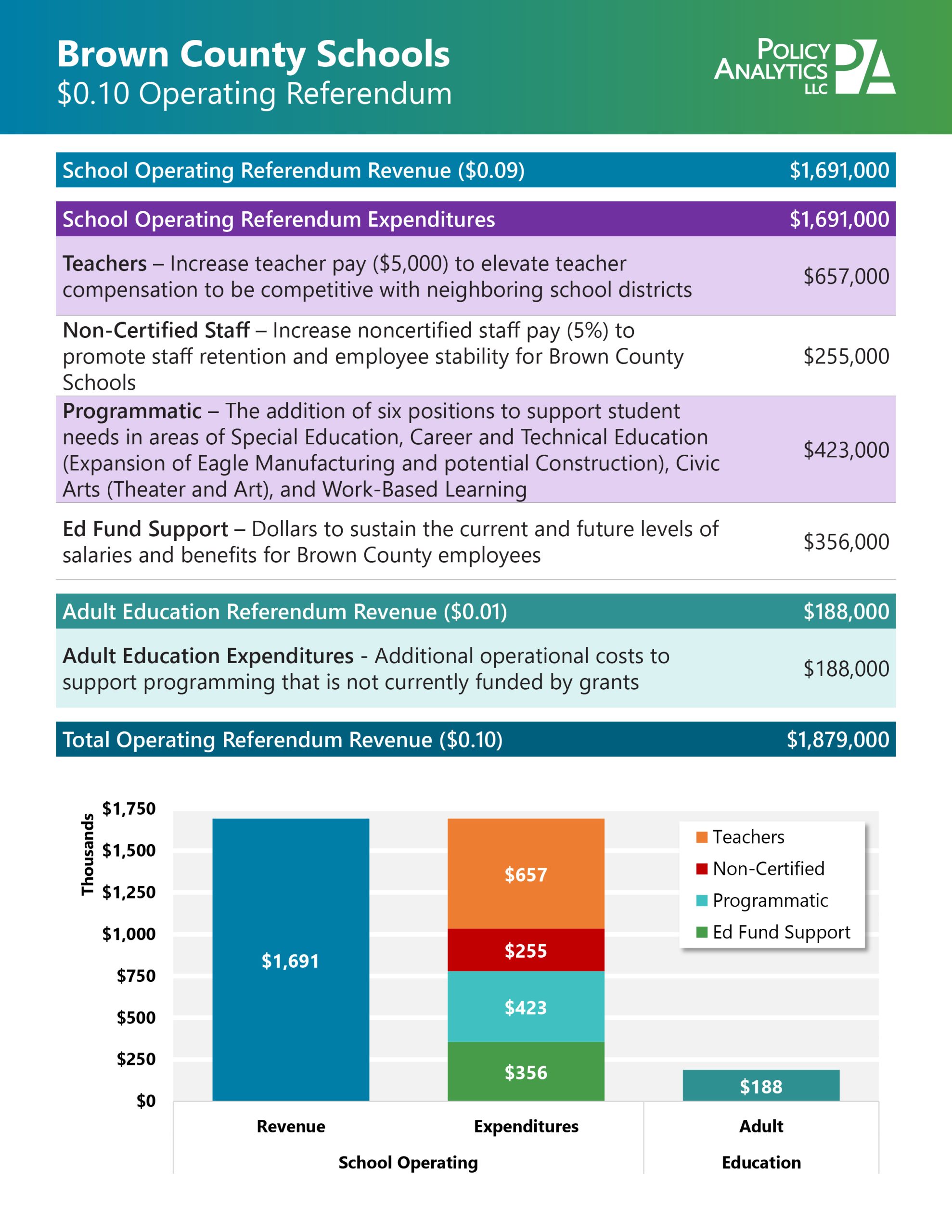

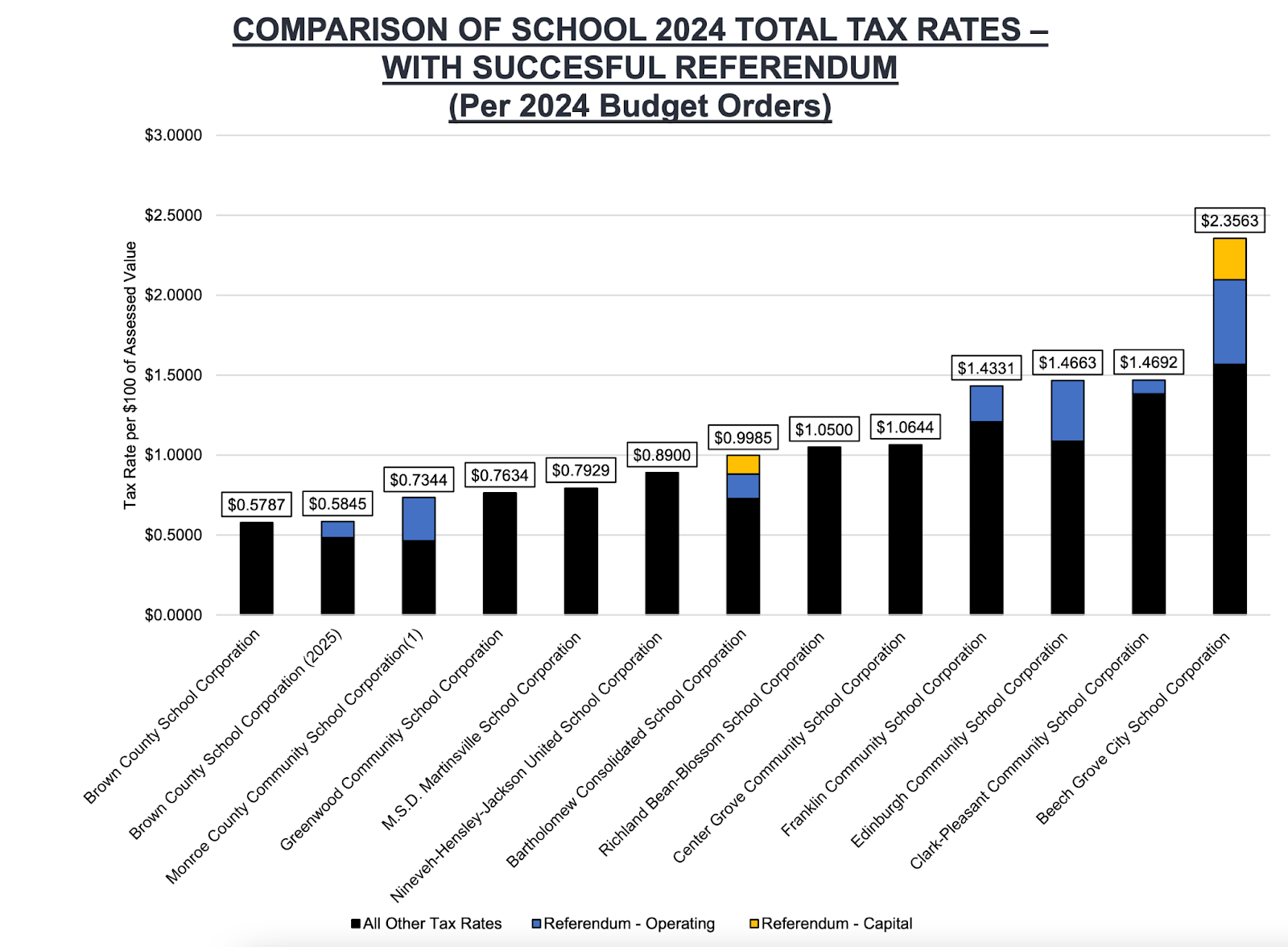

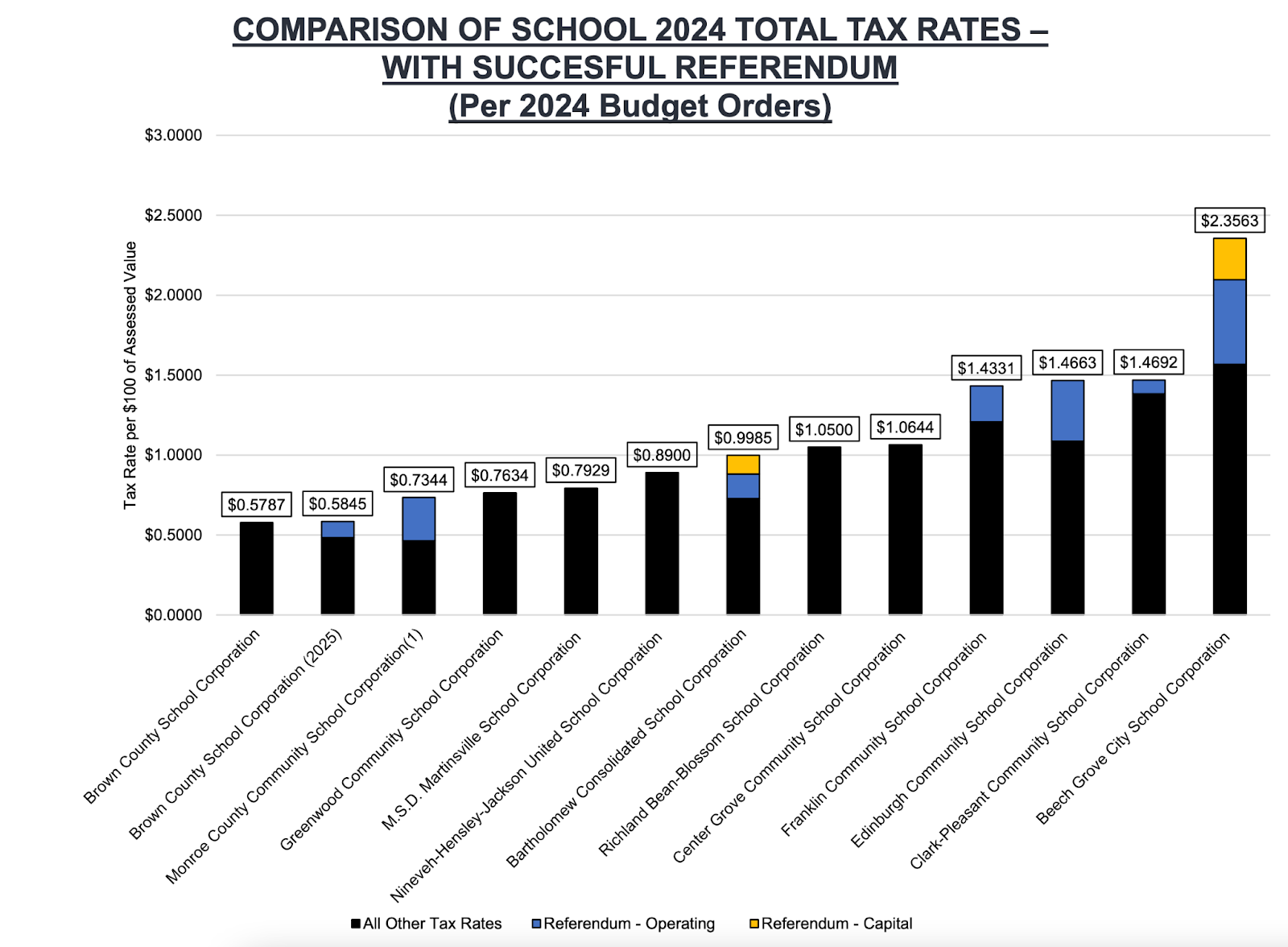

On May 7, 2024, residents will have the opportunity to decide if they will continue their investment in our schools and students by renewing the operating referendum at the rate of $0.10 per $100 of assessed property value to support competitive wages and benefits for our teachers and our staff and support our Career Resource Center.