Referendum 2022

World Class Opportunities. Small School Relationships. Lifelong Impact.

In 2016, voters residing within the Brown County Schools district approved an eight-year operating levy of $0.08 per $100 of assessed property value. Thanks to our community’s support of the operating referendum, BCS was able to continue funding the Brown County Schools Career Resource Center, and provide support for our teachers, staff, and innovative educational programs for our 1,569 students.

On November 8, 2022, residents will have the opportunity to decide if they will continue their investment in our schools and students by renewing the operating referendum at the rate of $0.12 per $100 of assessed property value – a $0.04 tax rate increase in the school levy. To the average home value in Brown County, this is an additional $3.26 per month.

» ensure the continuation of innovative programming.

» maintain small class sizes.

» reinstate Career and Technical Education courses (building trades, manufacturing, etc.).

» sustain the addition of the Early Childhood Education Center in Nashville.

» continue support for our students enrolled in special education courses.

NO REFERENDUM FUNDS WILL BE USED FOR CONSTRUCTION PROJECTS OR CAPITAL IMPROVEMENTS.

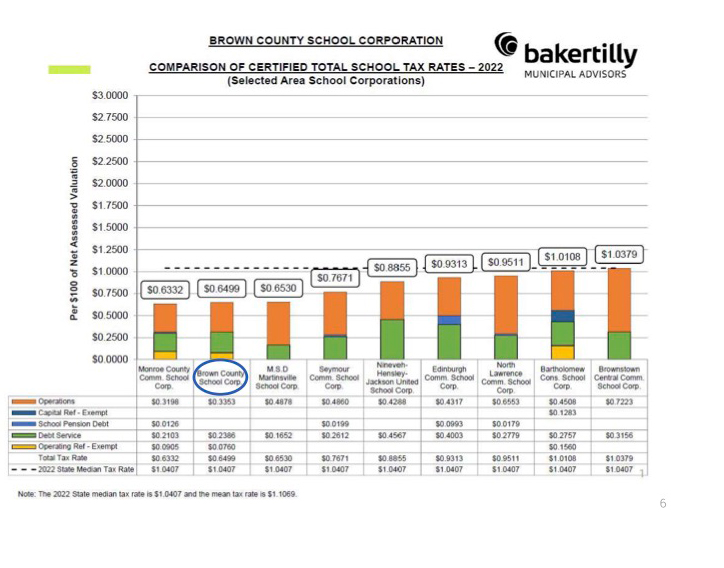

Brown County Schools has one of the lowest school tax rates of any corporation in this area. At $0.6499, the total tax rate for BCS is below the state median tax rate. Brown County Schools also receives one of the lowest rates for school operations at only $0.3353.

Comparison of Certified Total School Tax Rates – 2022 (Selected Area School Corporations)

In our continued effort to be transparent, we have established this webpage to provide local taxpayers with the information they’ll need to decide the future course of our Brown County Schools. We encourage residents to utilize the tax investment calculator to learn the facts about the amount of their investment in BCS. First, search for your property to find your Taxable Assessment Value. Then use that value to Calculate Your Adjusted Tax based on the proposal.

The current eight-year referendum, passed in 2016, is for an eight- year operating referendum of $0.08 for every $100 of assessed property value. One penny goes to the Career Resource Center and seven pennies go to employee salaries, benefits and programming across the district.

The current $0.08 school levy generates approximately $1.2 million per year – money that is needed to keep our school district financially sound. BCS currently uses 87.5% of these operating levy dollars to directly fund wages and benefits for our incredible teachers and support staff at BCS and the Career Resource Center.

The State strictly limits what we can spend the dollars we receive from them based on student enrollment numbers. These State dollars cannot be used to pay staff at our other BCS campuses like custodians, office secretaries, principals, nurses, bus drivers. However, we are able to use the money from the operating referendum to directly support these vital programs and staff.

The average teacher costs the district: $71,194.34

The average of all other employees costs the district: $50,836.27

1.2 million dollars equates to approximately 17 certified classroom teachers.

1.2 million dollars equates to approximately 24 of all other employees (custodians, office staff, nurses, bus drivers, support staff and administrators)

Without the referendum, absorbing $1.2 M annually dramatically affects our ability to operate this district.

We are currently in year seven of our current referendum. We are seeking to replace that $0.08 rate on the November 2022 ballot and increase it by $0.04, for a total of $0.12 per $100 of assessed property value. If we do not successfully pass the referendum, we will be forced to absorb approximately $1,200,000 back into our budget, which we cannot do while also continuing to provide highly effective student experiences, student outcomes, and athletic programs. We have chosen to run the vote in November rather than May 2023 because to do so in May would require an expensive special election.

The State dollars in our education fund cannot support any of the staff or programming at the Career Resource Center or the new Early Childhood Education Center in Nashville, and these two entities are vital to our entire county. We do not get funding for Preschool or Adult Education from the state. Brown County Schools have been able to expand opportunities for adult education over the years due to the last referendum and now over 16,000 participants have completed professional coursework to prepare them for better paying jobs. The Early Childhood Center is a need for the community in Nashville. Brown County Schools will be able to offer a full Birth-5 Program with the support of this referendum.

If the community votes not to support our schools, we will be forced to significantly reduce programming and services across academics, the arts, and athletics; freeze salary and wages for staff; and cut jobs across the district.

If the referendum fails in November, we will be forced to increase class sizes, eliminate teaching positions, and make major changes to our academic and student support programs. Our valuable programs that offer career education, summer internships, and other educational options will be drastically reduced. Our Career Resource Center, Early Childhood, Business and Entrepreneurship, and elementary science programs will face substantial cuts. Finally, programs in our theater, art, and music extracurricular activities will be cut. And our athletics program will face an uncertain future.

Brown County Schools can:

Offer competitive wages and benefits for prospective teachers and staff in order to recruit and retain the best of the best for Brown County students (this includes certified teachers, support staff, and transportation staff);

Ensure innovative programming and support small class sizes;

Reinstate our Career and Technical Education courses, such as construction, trades, manufacturing, etc.;

Sustain the addition of a much-needed Community Early Childhood Education Center in Nashville.

Since 2016, BCS has made the following budget modifications to cut costs and to continue to ‘do more with less’.

In the first year of initiating these cost saving measures, BCS saved taxpayers $4,573,000.